GDI Global Commentary

07/16/2025

Yes, it has been a long time since my last commentary. Now that I have completed my doctorate, it has taken me some time to regain the enjoyment of writing.

Some key insights as we finish 2025:

Don’t Get Complacent

The first half of 2025 has been marked by noise and uncertainty related to the economic and inflationary impacts of tariffs and other policies. For the most part, however, the U.S. economy has displayed a surprising level of resilience. Despite a new administration enacting sweeping reforms in trade, immigration, and federal employment, market reactions have, for the most part, been muted. Both equities and bonds have posted respectable year-to-date returns, while unemployment and inflation have remained stable.

However, beneath this seemingly calm surface lie delayed policy and economic effects with the potential to disrupt what has been, to this point, a relatively benign investment environment.

Pragmatic Risk Awareness and Diversification Are Now More Critical Than Ever

The policy activity emanating from Washington in 2025 hasn’t created meaningful market shocks, mainly because the implementation timelines are not aligned with the rhetoric. The impact of tariffs, for example, began to take effect only in the second quarter and is still being layered into trade. Similarly, immigration enforcement actions and federal job cuts are only beginning to ripple through labor markets, despite being announced months ago.

What’s more, while headline CPI may not yet reflect significantly higher input costs from tariffs or labor shortages, that does not mean the inflation risk is removed, as shown by yesterday's higher-than-expected CPI report, coming in at an increase of 2.7% YoY. This result is meaningfully higher than the Fed’s 2% target. From my research, it appears that retailers are still working through their existing inventory and are only now beginning to layer in price markups. And employers, many of whom are still gun-shy from the labor shortages of previous years, have not yet responded to weaker business activity with layoffs. However, history shows us that when the time comes, it tends to happen swiftly and in large numbers.

Finally, please pay attention to consumer spending, as it accounts for nearly 70% of GDP growth, as well as unemployment numbers, as we close the year. People without jobs don’t spend, and companies can't make money if people don’t spend, and economic growth can’t happen if companies don’t make money. This is the primary reason I believe valuations are relatively high compared to the potential of the equity market.

Valuation Fragility and the Need for a Diversified Approach

From a global markets perspective, stock market valuations remain elevated, and credit spreads remain relatively tight. Narrow credit spreads are unlikely to hold in the face of mounting economic challenges, and the assumption that current market pricing accurately reflects the probable upside of many companies in the coming years could prove dangerously optimistic.

The Interest Rate Outlook: Range-Bound and Steepening

Despite policy shifts and potential headwinds, I continue to see interest rates as range-bound in the near term, with a decline in the front end of the curve and a steepening overall as we head into next year. The uncertainty around slowing growth and inflation impacts may keep rates from breaking out materially in either direction; however, in this environment, yield stability can change at any moment and should not be confused with lower risk. If we look at the 50-year historical average yield of close to 6% and the 30-year average of around 4% for the 10-year Treasury, at the current yield of around 4.5%, we are likely more normal now than at any time in the previous 20 years. I don’t see rates reaching the levels we saw 15 years ago anytime soon. What provides additional support for this conclusion is the recent decline in the USD and the rating agency downgrade.

Final Thoughts

I don’t feel that the economy of 2025 is broken or on the path to recession, but it is certainly vulnerable to lower prices and increased volatility. With valuations stretched and the full weight of policy actions still working their way through the system, we must not be lulled into complacency. Now is the time to ensure portfolio allocations are diversified, evaluate and test risk assumptions, and ensure exposures are focused on value stability and cash flow.

As always, I remain available to discuss these market realities in greater detail.

Until next time: Position Globally, Allocate Conservatively, Invest Completely.

08/26/2020

COVID, an Election and 2021

A lot has occurred in global markets in the six months since my last commentary. The equity markets have, for the most part, returned to pre-COVID levels and spreads have improved in most fixed income structures, except for the oil and gas space of course. In less than 5 months since one of the greatest selloff’s in modern global markets history, we are mostly “back to normal” in terms of broader market valuations. This reality provides both support for the case of fundamental asset allocation and risk management I have been communicating for over 20 years, as well as a warning against allowing complacency to set in again. The assumption could be made based on the relatively quick return of valuations that 2021 will be just “fine” in the markets. This commentary is designed to help you look toward 2021 optimistically, but more importantly, pragmatically.

As investors, we all have varying ideas about probable outcomes given certain drivers. As we close 2020 and begin to plan for 2021, there are numerous significant aspects that have the potential to derail the markets establishment of premium valuations and impact the U.S. economy at large. The most significant of these drivers is the coming presidential election. Presidential elections have historically been good for equity markets as the outcomes are either a maintenance of a status quo or a prospect of positive change. Having said that, I do not believe that this upcoming election will provide a similar positive impact. The political divide has become so intense that uncertainty around who will win due to ballot-related items and political debate may delay the determination of a winner of our country’s highest office for months, and maybe longer. As I have mentioned many times before, the markets hate one thing more than just about anything else, uncertainty.

The next major driver and point of uncertainty relates to the COVID outcomes and responses in late 2020 and early 2021. No matter what your opinion is of the virus or your political ideologies surrounding it, the economy and your investment portfolio will be impacted by government and medical industry responses to it. Remember, over 70% of GDP growth here in the U.S. is the result of consumer spending. Though much of the consumer spending on things like restaurants and entertainment has been deeply curtailed due to the lockdowns, those that have maintained employment outside of those industries are continuing to spend the money they earn, and the money given to them through the stimulus. This explains, for the most part, the equity market valuations in the last 5 months. The question that is yet to be answered in this regard relates to what the medium to longer-term impacts will be on the industries that have suffered deep losses as a result of the virus. These impacts are made even more uncertain by the potential for additional lockdowns, stimulus and a viable vaccine. Again, cautious optimism founded in a pragmatic approach is key. Volatility will undoubtedly return as we close 2020 and begin 2021, due to the factors mentioned above. The last 5 months have shown us again that having a level head and staying the course by holding solid diversified exposures, is the best way to deal with uncertainty, take advantage of discounted pricing and remain invested without being consumed by fear. As always, never hesitate to reach out to me directly to discuss any of this in greater detail.

Until next time Position Globally, Allocate Conservatively, Invest Completely

02/28/2020

Long Overdue

To say that this latest market correction is long overdue is an understatement of the highest magnitude. Based on last year’s 30%+ gains in the S&P 500 and the preceding 9 years of solid appreciation in equity markets, the GDI diversified asset allocation framework appeared to underperform from both a risk and return perspective. This week’s realties in the global markets landscape reveals the reasons the framework was created and how it has benefited clients of the firm. The content from my last commentary “3/4’s and 2020” is even more significant today than when it was written last year. When any investment is continuously posting gains over an extended amount of time and those gains become regularly separated from fundamentals, complacency develops. This complacency creates an environment where investors become less concerned about risk and more concerned about returns. The risk of a “tail event”, as described to readers in previous commentaries and potentially being experienced now with coronavirus, seems so improbable that considering implementing proven risk management concepts such as diversification and correlation management become, for lack of a better description, a waste of time.

As a professional in the space I have come across a handful of individuals in the last few years that have concluded that averaging into the S&P 500 is the only investment strategy that really works. Basically, trying to beat the market from a risk and return perspective is not worth the effort. Though the previous 10 years have displayed this fact to be true for the most part, what about the downside risk when the market does what it has done this week? Is incorporating downside protection worth the time and effort? My answer to this question is always, yes. Though I cannot share specific GDI client statistics, YTD losses across all portfolios managed to the asset allocation framework are meaningfully lower than the over 11% YTD losses in the S&P 500. If any reader is interested in learning more, my contact information is listed on the contact page of globaldiversifiedinvestments.com.

The question readers probably want the answer to today is, “What does this mean for my investment portfolio in 2020?” In short, that depends on your outlook for the impact of coronavirus on global growth and the alteration of otherwise solid fundamentals here in the U.S.. Coronavirus, as of right now and based on information I have uncovered, is not at the level of structural risk that would guarantee a recession and be identified as at “tail event”. There is real risk of negative impact on global growth, yes, but not recessionary risk. That said, risks do remain as a result of the fact that outside of coronavirus, there are other pressures to consider. This is where the focus of GDI on exposures that are approximately 40% correlated to the market, have cash flow and are structurally diversified is of real benefit.

In closing, remember that becoming emotional about the market and your portfolio is always negative. If you are invested in a way that incorporates a solid risk management methodology and the funds are identified as long-term in nature, even the worst market selloffs and recessions are truly transitory.

Until next time, Position Globally, Allocate Conservatively, Invest Completely

04/18/2019

3/4's and 2020

Capital markets and the global economic environment have provided a good amount of intrigue in the last 8 or 9 months, to say the least. The Fed has been at slight odds with the President, which for as long as I can remember was not really an issue we have ever had to deal with. Brexit and the overall uncertainty surrounding its impact remains heavy in the region and Chinese growth and trade realities waffle between good and not-so-good news on a weekly basis. The yield curve inches ever closer to meaningful inversion and the IMF lowered their global economic forecast to 3.3% for 2019 (down from 3.5% posted in January). In that same report, they now expect U.S. growth to be 2.3% for the year, which they lowered from January’s number by 0.2%. One positive, however, is that their expectation for Chinese growth is forecast at 6.3% for 2019, which was an increase of 0.1% from January’s number. The next 3/4’s will likely flow with similar themes represented these and other economic and market indicators to come. There remains support for maintaining and adding strategic global exposures as we close the year, especially in fixed income. Realizing the objective of obtaining non-correlated returns and risk management benefits in all portfolios is becoming paramount.

The current and upcoming economic realities and lingering risks provide an opportunity to reiterate how sound fundamentals alleviate not just uncertainty, but also provide much needed comfort in that uncertainty. For those of you that have read my commentaries for any amount of time, you realize this theme throughout all the years I have communicated my strategy. What I would like to also communicate is that this framework of thought has guided my overall approach to investing for over 20 years. One of my favorite quotes from Warren Buffett is “Be fearful when others are greedy and greedy when others are fearful.”. I realize that I have communicated this quote before, however, I will now address why I think he places the words “fearful” and “greed” in the order he does within that statement.

First, Mr. Buffett starts his quote with addressing greed in others. The reason I believe he does this is that it is the greed, the run up in prices and the resulting crash which has the greatest negative impact on an investors and broader market psychology. Misinterpreting greed and exaggerated valuations have resulted in devastating effects on wealth for generations. A positive, at least for those founded in sound investment frameworks, is it provides the greatest opportunity to add good investments on the “cheap”.

This leads me to the second part of his statement relating to our “greed” when others are fearful. Though I have not had the opportunity to speak with Mr. Buffet personally about this, I believe that it is not the same type of greed mentioned in the first part of the quote. Our greed is one that is to be rooted in fundamentals and strategy and when executed in that vain, the long-term value will be undeniably positive. Using this approach in building a resilient portfolio and maintaining an unemotional mindset when approaching your investments is key to sound risk-managed returns and limited losses. When investment management is approached in this manner, it provides a solid foundation for weathering all economic cycles.

For my outlook for 2020, I am still expecting that the U.S. economy will face recessionary pressures. I will state again that baring any “tail event”, these recessionary pressures will be no where near a 2008-level scenario and that recessions, in general, provide opportunities to add quality holdings at optimal prices. Much of the reason I still feel recessionary pressures exist is based on a few fundamental economic components. First, inflationary risks are becoming more significant. Oil is up 42% for the year so far and the Wall Street Journal reports that twice as many U.S. companies have raised median pay when compared to last year. This puts pressure on company earnings and when that pressure is combined with slower growth, companies will begin to tighten their belts and approach any new business investment and hiring much more conservatively. Secondly, student and consumer debt has reached new highs of late and there is a considerable risk to consumer spending as a result. Consumer spending drives over 70% of GDP growth, so even a moderate change in spending will have negative economic results. Lastly, interest rates and the yield curve are beginning to show signs that investors are needing to be compensated more for risk, especially in the shorter-term. Risk pricing has not been at the forefront in recent years, however, it will be again very soon. The increases in rates, especially in the short-end of the curve, and the resulting impact on consumers, companies and governments will put pressure on the economy. When these realities are combined with a diminishing global growth picture and trade uncertainties, there is a high likelihood growth will slow in 2020. But again, recessions are not to be feared, they are to be exploited.

I will close with the offer to speak to any reader directly about this, or any other economic or business reality. As an adjunct professor at two universities, I find myself being called to continuously improve on how I help prepare individuals for the probable outcomes we all face in the financial world. Whether or not you are interested in my investment framework, feel free to shoot me an email to arrange a time to chat.

Until next time Position Globally, Allocate Conservatively, Invest Completely

11/08/2018

Volatility, Jobs, Rates and More Volatility

The recent drastic fluctuations in global markets has delivered on a volatility story that has been more significant than even I expected and wrote about in my commentaries leading up to today. Volatility as represented in the CBOE Volatility Index, more broadly known as the VIX, went from posting numbers between 11 and 18 (around 40% fluctuation) in the last 6 months to going from 11.61 in early October to 25.23 (over 50% fluctuation) in the 20-days closing out the month. The 200-day moving average for the VIX sits at just over 14.6 and it is listed at around 17 this morning. Given the markets whipsaw behavior recently and the continued uncertainty around trade, China and interest rates, the volatility story is likely not going to change anytime soon.

The drivers of this volatility relate to many of the fundamental factors I have presented before, as well as a few that I have not. I read an interesting article recently that pointed out the relative size and impact of what they described as program trading and the automatic algorithms and complex trading strategies that buy and sell according to pre-established frameworks. The basic conclusion was that volatility is exacerbated by these machines buying and selling large volumes of holdings based solely on price movements. As I have stated many times before, at GDI we are investors, not traders, and I diligently seek out diversified exposures that will provide solid value into the future. This does not, however, eliminate the direct exposure to the risk of volatility, it simply creates an opportunity to hunker down and verify that the fundamental portfolio strategy and design can withstand the volatility in order to accomplish the overall objective of the portfolio into future years. It also provides opportunities to add strategic exposures that may be trading at historically lower levels.

Earnings reports from firms have been decent overall and Nonfarm Payrolls came in recently rising 250,000 from last month, which topped the median estimate of 200,000 from economists. As a result, the unemployment rate stands at a 48-year low of 3.7%. Jobs, spending, and company earnings that justify P/E ratios are all integral for a continued appreciation of investment assets. One notable item related to jobs is the reported increase in average hourly earnings of private workers rising by 3.1% for the year. This is the largest increase in about a decade. This reality will undeniably put pressure on the bottom lines of employers and squeeze margins across many organizations. It will also provide the Fed with sound justification related to inflationary pressures for additional rate increases in coming meetings. Additionally, there are reasonable risks to company earnings when employment costs rise AND interest rates rise at the same time. For the sake of not restating my expectations and timing estimates for a recession from my last commentary, I will simply state that these two factors only contribute to the broader risks of a recessionary condition.

In closing, I want to reiterate that the volatility in the market should be viewed as a necessary byproduct of the current investment landscape. And if you don’t need your investment funds turned into cash in the short-term, the volatility can be weathered unemotionally and soundly by executing a disciplined investment framework and taking advantage of discounted pricing on solid exposures that generate value in the years to come.

Until next time Position Globally, Allocate Conservatively, Invest Completely

07/03/2018

1/2 ONE of 2018 and the Dreaded “R” Word

For the most part, the first half of 2018 delivered much of what I tried to prepare readers for, and some, which I did not. First, global market volatility began to really get a foothold as we closed the first 6 months of the year. Most of you likely recognized this fact by listening to the talking heads in the financial media or looking at your monthly portfolio valuation variances. I had expected the volatility of global markets to become more significant in 2018 and communicated that fact in my recent commentaries; I just did not expect much of the volatility to come from the risks of a trade war instigated by the President.

Secondly, the Fed was on track to raise rates at a consistent pace this year, however, I had a greater weight on wage growth as a contributor to inflation (and the rapidity of the rate response) than what actually occurred this first half of the year. There are a few reasons for this disconnect, but I will leave that discussion to the few of you that call me directly to speak about such things. Thirdly, the performance of the GDI Asset Allocation Framework performed reasonably well overall in the first-half as there remained optimism for global economic growth and corporate earnings. There have been some price pressures recently on assets exposed to China and other emerging economies as a result of the building uncertainty around trade, and the relative value of those portfolio exposures has reflected that in recent weeks. I will step out again in defense of such exposures and state that those holdings, though pressured in the short run, remain viable for recognizing the longer-term value of diversified global growth in the coming years. I will qualify that by stating that the recent volatility is here to stay and that the second-half of 2018 will potentially be even more uncomfortable in terms of daily price swings. This is due to the existing pressures such as trade, being combined with the ever-increasing debt loads of institutions, consumers and governments. As rates rise and debt loads have ballooned to historical levels, it rarely ends well for the markets overall.

This leads me to the discussion about the dreaded “R” word, Recession. I want to let readers know that the word recession is coming up regularly in things I read lately, and as you all probably already know, a recession is an inevitable part of every cycle. We are unfortunately due for one here in the U.S. just in terms of time since the last one. We have been in 9 years of expansion, which is close to the longest in U.S. history, without a recession. The average is somewhere around 6 years. As a result of this, and a few other compelling factors, some are suggesting a recession in the U.S. could start as early as 2019, with the majority of economists stating 2020 will likely be the year it begins. Will it be as bad as the last one? Probably not, however, we should begin to prepare nonetheless. Rick Newman writing for Yahoo Finance states that the next recession could see a, “Wrenching upheaval in the job market, abrupt changes in the value of some investments, and political turmoil as policymakers grapple with new constraints on the government’s ability to respond.”

Generally speaking, recessions put pressure on jobs, asset values and usually instigate some level of government stimulus. A real issue is that there may be less available impact from any government intervention due to the relatively-low starting point of interest rates, which when decreased, has historically been a powerful tool in juicing the velocity of money. What’s more, job losses may be more permanent as automation begins to fill the human component in certain parts of the economy. Now to the question you are all likely most concerned with, what will be the impact on the investment assets you hold? The analysis presented below should provide you with a tool to help manage expectations in that regard.

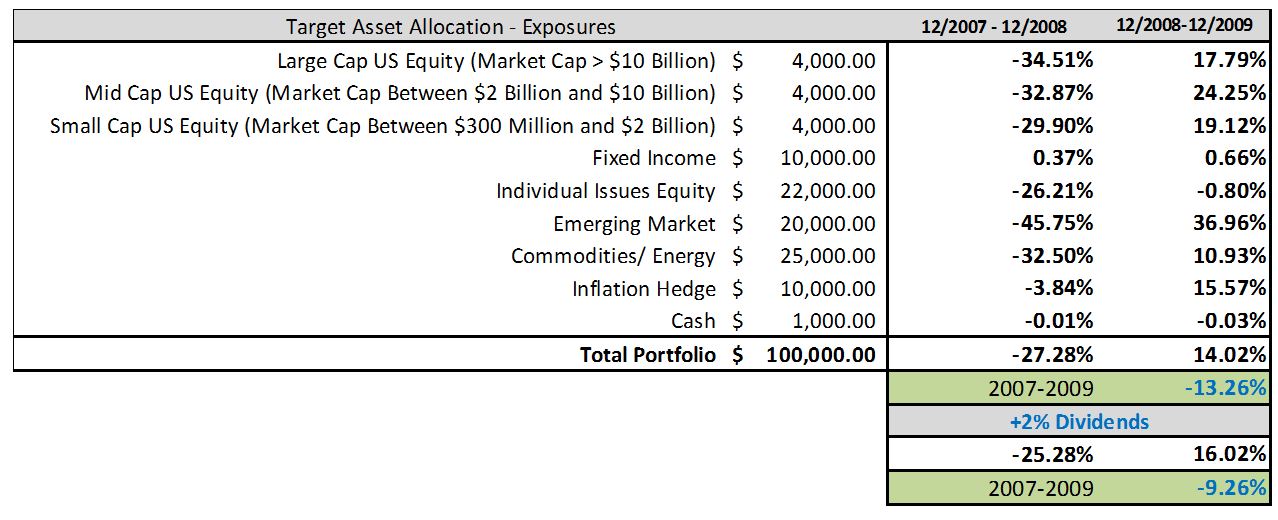

I have taken the current GDI Asset Allocation Framework as it is implemented in the base portfolio, and even though exposures vary between each client here at GDI, the table below displays how the fundamental existing allocation framework would have responded through 2007-2009 on a weighted average basis for a simple USD 100k portfolio. I utilized widely used indices for each exposure category and stated their relative performance each year. The previous recession was by far the worst in our history and impacted global markets significantly and as I already mentioned, most do not expect the next recession to be as painful. Having said that, and considering the GDI Asset Allocation Framework is designed as a 4-to-8-year strategy, the two-year impact using the worst recession as an example and considering a 2% dividend (estimate for the framework), the portfolio loss would have only been just over 9%. I would like to note that this loss on these exposures was well-overcome in the following years. My point is that selling those exposures in the last recession for USD, only to buy them back at some point would have incurred trading costs, tax implications and also, probable timing inefficiencies. Would I have bought them back at the “right” time? Remaining steadfast and invested in the strategic asset allocation exposures in the worst recession in our history would have resulted in 2 years of minor valuation pain while enabling entrenched participation in the next 9 years of expansion and valuation growth. I present the analysis by confirming that historical performance is not an indicator of future performance and that each investor should perform extensive due-diligence on investing and trading tactics for their respective portfolio exposures in any and all market and economic conditions.

In closing, Mr. Newman in that Yahoo Finance article puts it best by stating, “Recessions also create opportunities, for those able to ride them out. Investors with cash on hand can buy low as stock prices drop. Homes become more affordable as prices moderate and interest rates fall. Businesses have access to a broader pool of workers. And employers shifting strategies become interested in new forms of innovation.” I have come to the conclusion that, if anything, recessions are a time to add even more of each exposure at discounted prices, so I am sort of looking forward to it.

Until next time Position Globally, Allocate Conservatively, Invest Completely

03/19/2018

My quote on a forum from 12/07/2017 relating to BTC, “Be careful people, assets are only worth something if they provide stable value into the future”.

First, this is not to discredit or delegitimize any asset allocation strategy. This note and following graphics are designed to provide insight into how the GDI Asset Allocation Framework is implemented. Second, this is not a recommendation or suggestion to buy or sell ANY security, asset or instrument. Finally, feel free to reach out to me directly to discuss and remember; building wealth is not the same as getting “rich”.

The GDI framework includes numerous securities that provide a particular target risk profile and relative return benefit to each managed portfolio. The holding I use for the example below is The Boeing Company (Ticker BA). This company was added to the GDI Asset Allocation Framework many years ago as a result of its sound fundamentals. It is a company valued at around $194 Billion; it has an attractive 5-year price profile and pays a dividend of over 6.75%. Though the price has been bid up in recent years, the PE remains under 25. I have compared the price characteristics of BA and BTC over a period of 1 year and have displayed the relative price profiles from 12/07/2017 below. This corresponds to the date of my initial note of caution.

The final point I would like to make is that I highly recommend a prudent, risk-managed approach to investment management. I suggest understanding risk appropriately and that you adequately grasp your investment decision(s) impact(s) on your broader financial goals. Risk management requires a disciplined approach that is free from market hysteria.

Until next time, Position Globally, Allocate Conservatively, Invest Completely

Year-End Analysis 2017 & Insights for 2018

2017 was a year where equity valuations continued to demand a premium, nuclear threats were brought up regularly and Bitcoin became a household term. It was a year that began with a great deal of optimism for economic stimulus from the new President’s infrastructure and tax plans and positive expectations for global growth overall. It was also one that regularly revealed a pervasive issue facing government, Hollywood and the American workplace as a whole.

My role as investment adviser and teacher provided me the opportunity to extrapolate guidance from numerous sources throughout the year. My conclusion after digging deep into those sources can be summed up by the historic quote "The more things change, the more they stay the same," (Les Guêpes, January 1849). Bitcoin was bid up to extraordinary levels through what has been best described as a “gold rush mentality” and experienced volatility reminiscent of the frenetic trading that occurred back in the dot-com boom (and bust). President Trump’s tax reform plan became a reality, passing in both houses of congress, whilst attracting unrelenting partisan headwinds the entire way. And unfortunately, the American workplace appeared to be no safer for women than before laws existed to protect them. Seriously, where have all the gentlemen gone? Lastly, we were seeing long-range rockets being launched, which could potentially bring a nuclear threat right to our front door.

What does all of this mean for investors and for your portfolio specifically? In a nutshell, everything. Culture, safety and the resulting consumer attitudes and spending that occurs when fundamental government and economic structures are healthy is positive for investing and diversified portfolios as a whole. Any combination of negative effects on these, however, can become extraordinarily painful and fuel uncertainty. Helping my clients manage the potential uncertainties will be my focus in 2018.

I will start with a quick assessment of Bitcoin and the overall crypto and blockchain environment. For many readers, Bitcoin became a term heard daily in 2017 and as we begin 2018, I have been receiving calls from various individuals, all with the same basic premise of seeking guidance on how they could get “in” on the space. I cautioned the early adopters of Bitcoin about the overall risks associated with a global unregulated currency years ago and though some may suggest I am a “dummy” for not putting money in then, I am convicted by my standards of investment protocol. This is not to say that Bitcoin, or any other crypto-currency for that matter, is not inherently valuable or that currency independence and transaction efficiencies are not worthy of pursuing by any means, I just have a diligent focus on risk management and volatility management and Bitcoin has never made its way into that fundamental framework due to its parabolic price moves. Having said that, I believe blockchain and the crypto space has extraordinary potential and I will be working hard in 2018 to learn how blockchain and Ethereum can provide not only a global currency alternative, but also value-based functionality in terms of agreements and other processes. I will not bore you with the details here, but I am happy to chat personally with you regarding this quickly-developing space. Crypto-currency and blockchain technology is here to stay and it provides solid opportunities for improvements in numerous industries from cyber-security to retail to government and to healthcare, but as with any investment, you should be prudent first and opportunistic second.

From a global markets perspective, there continues to be support for broader asset appreciation and solid returns for well-diversified holdings into 2018. Though returns may be lower than in 2017, the tax legislation could provide a boost to earnings of corporations and overall business optimism, and there remains opportunity for emerging market and other global exposures to outperform based on global growth and a continued USD weakening trend. Additionally, as interest rates start to rise, there are some benefits to owning strategic fixed income investments. I continue to have cash ready on the sidelines for placement and will start tactically purchasing specific holdings for many of the portfolios I manage once valuations become reasonable from a historical basis. The S&P 500 index still stands at a historically-expensive 18.2 P/E, while the 25-year average is 16. This is considering that we have had a few good earnings releases and a significant portion of the firms in the index are exposed to global markets and, as a result, benefit from USD depreciation. USD as represented by the Bloomberg Dollar Index stands at a 3-year low and for the reasons I mentioned back in 2016, it still has room to depreciate further due to fundamental and technical drivers.

JP Morgan reports that corporate cash as a percent of assets is around 30% compared to 20% ten years ago, and even though YoY GDP growth here in the U.S. remains below the average of 2.8%, both real housing starts and capital goods orders are both standing at or near their respective 20 year averages. The reason I bring this up relates to the real prospect that this equity market price appreciation could be supported by these and other related statistics in 2018. Most economists are expecting global GDP growth to be over 3% in 2018 and the IMF forecasts that 2018 will have the fewest countries in recession since they have been forecasting such things. The U.S. Federal Reserve Bank has a new chairman named Jerome Powell who is taking over for Janet Yellen, however, many expect much of the same in terms of commentary and policy. Lastly, Goldman Sachs is placing a 10% probability of a U.S. recession in 2018 given the favorable global backdrop. They did, however, go on to on to state the risk of a market pullback is higher in 2018 given the current levels of valuation.

Some not-so-great-news is that in spite of interest rates on mortgages being well below the 40-year average of over 8%, housing affordability is 30% less than the 40-year average and home prices relative to income are nearly 20% higher. Also student debt is reported to be at 10% of the debt on consumer balance sheets, which will undeniably affect spending for those individuals for many years to come. The flipside to this potential negative is that as Goldman Sachs reports recently, “Debt as a share of GDP has declined for households, financial institutions, state and local governments, and the aggregate private sector”. It is a bit unsettling to read in that same report, however, that “There are nearly four times as many bulls as bears in the most recent American Association of Individual Investors’ (AAII’s) survey, close to an all-time high.” Remember though, being overly bullish does not kill a bull market, fundamental flaws in structure and irrational valuations do.

When an asset is purchased, it should not just be because of its return potential, but also its contribution to the strategic exposure mandate and overall portfolio value for the medium-to-longer-term. Exposure management has never been more important in order to achieve non-correlated returns and improved risk profiles. Global risks like polarization in the US, growing populism globally, heightened geopolitical tensions, terrorism and the potential for cyberattacks are not going away anytime soon. One thing that I can confirm is that the sound, well-diversified approach to investment management that GDI has implemented in the last 8 years, has displayed that a prudent and strategic approach, though not particularly exciting, provides stability in many market conditions that we have faced and will face into 2018 and beyond.

Until next time Position Globally, Allocate Conservatively, Invest Completely

2017 First-Half Results & Second-Half Outlook

Much of the expected market volatility I spoke about in my previous commentaries has not (yet) meaningfully materialized in this first half of 2017. I will note, however, that the aforementioned volatility still remains a solid potential given a few reasons, including the fact that the S&P 500 Index is trading at a price-to-earnings ratio of nearly 25, while the historical average is somewhere around 15 and the Dow Jones Industrial Average has also now pushed over another psychological barrier, trading at over 22k this morning. I suggest maintaining a prudent approach to adding assets in this market and continue to support the case for adding strategic exposures in any market correction. Having said that, and before I provide an outlook for the remaining half of 2017, I would like to cover a few things that have provided notable impact to a globally diversified portfolio framework in this first-half.

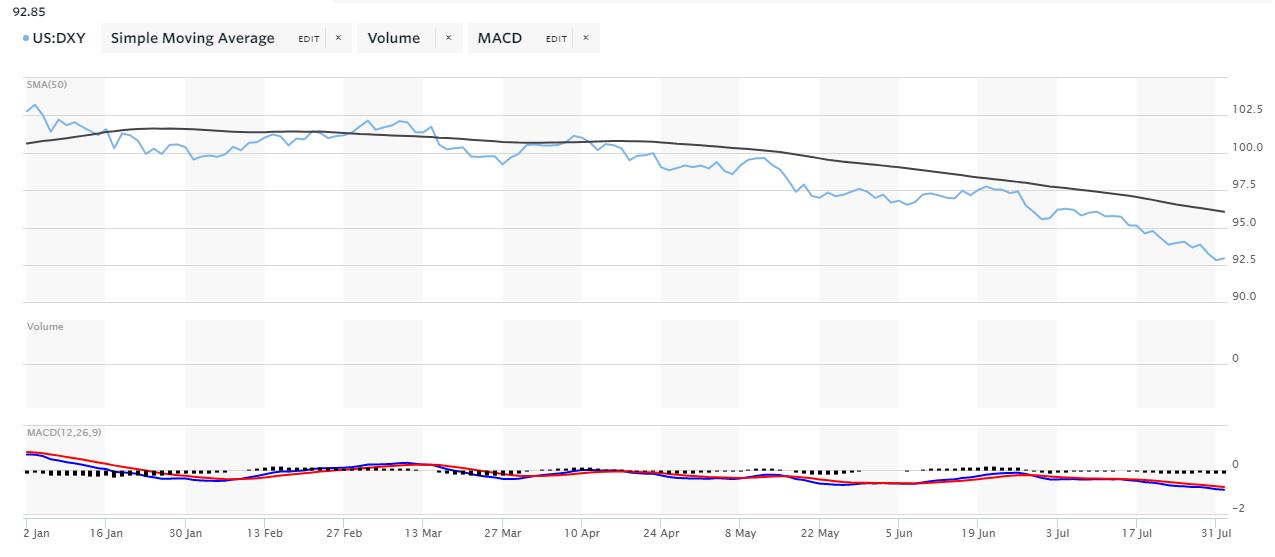

First, the pressure on US Dollar, which I have been bringing up in just about every commentary since mid-2015, is now alive and kicking. The dollar is down 9.19% so far this year as measured by the DXY, which The Wall Street Journal reports as “Its worst stretch in six years, as investors turned more confident that the economic recoveries around the world are gaining or surpassing growth in the U.S.” They went on to state that the US Dollar lost 1% in the last week of June alone. Bloomberg reports that “Speculator and hedge-fund net short positioning on the dollar have risen to the highest number of contracts since 2013, according to the latest CFTC report. The currency slumped to a five-week low against the yen”, and that “The U.S. dollar wrapped up July with its fifth monthly loss, the currency's longest losing streak since 2011”. There are a few drivers of this, including the global economic growth prospects vs. the U.S. as well as many market participants coming to the realization that the benefits of infrastructure or other growth facilitation the Trump administration promises will take more than a few months to meaningfully impact domestic GDP growth. I have included a year-to-date chart of the DXY (US Dollar Index) below for your reference.

Some are now calling for a potential “major” turn in the USD in the second-half as it is nearing its average bull-run-time of 7 years. Morgan Stanley expects Emerging Markets to expand at 4.7% this year, which I think is conservative for that particular exposure and further supports the potential for USD depreciation into the final months of 2017. What’s more, hedge funds and other speculative investors, according to the Commodity Futures Trading Commission, had $28 Billion of bullish USD bets late last year, which has declined as of June 27th to only $2.7 Billion.

Lastly relating to USD, GDI clients that have strategic exposure to inflation hedges through holdings in precious metals and other commodities, I will remind you that USD decline generally equates inflation pressure. Though gold is less of a hedge than in years past, it remains a solid alternative to holding cash in a specific currency and generally moves inverse to inflation rates domestically, which erodes most other asset returns. RealAssets Adviser Magazine suggests, “Given implications for declining intrinsic values of U.S. financial assets, as well as ongoing Fed efforts to debase outstanding debt obligations, gold remains a mandatory portfolio asset”. The conclusion I would like readers to arrive at is that the benefits of being invested in a globally diversified and strategic portfolio and being exposed to solid global exposures both locally and abroad, makes a weaker USD a benefit. Exposure considerations are primary in every investment decision I make and the next few years will highlight the benefits of that approach.

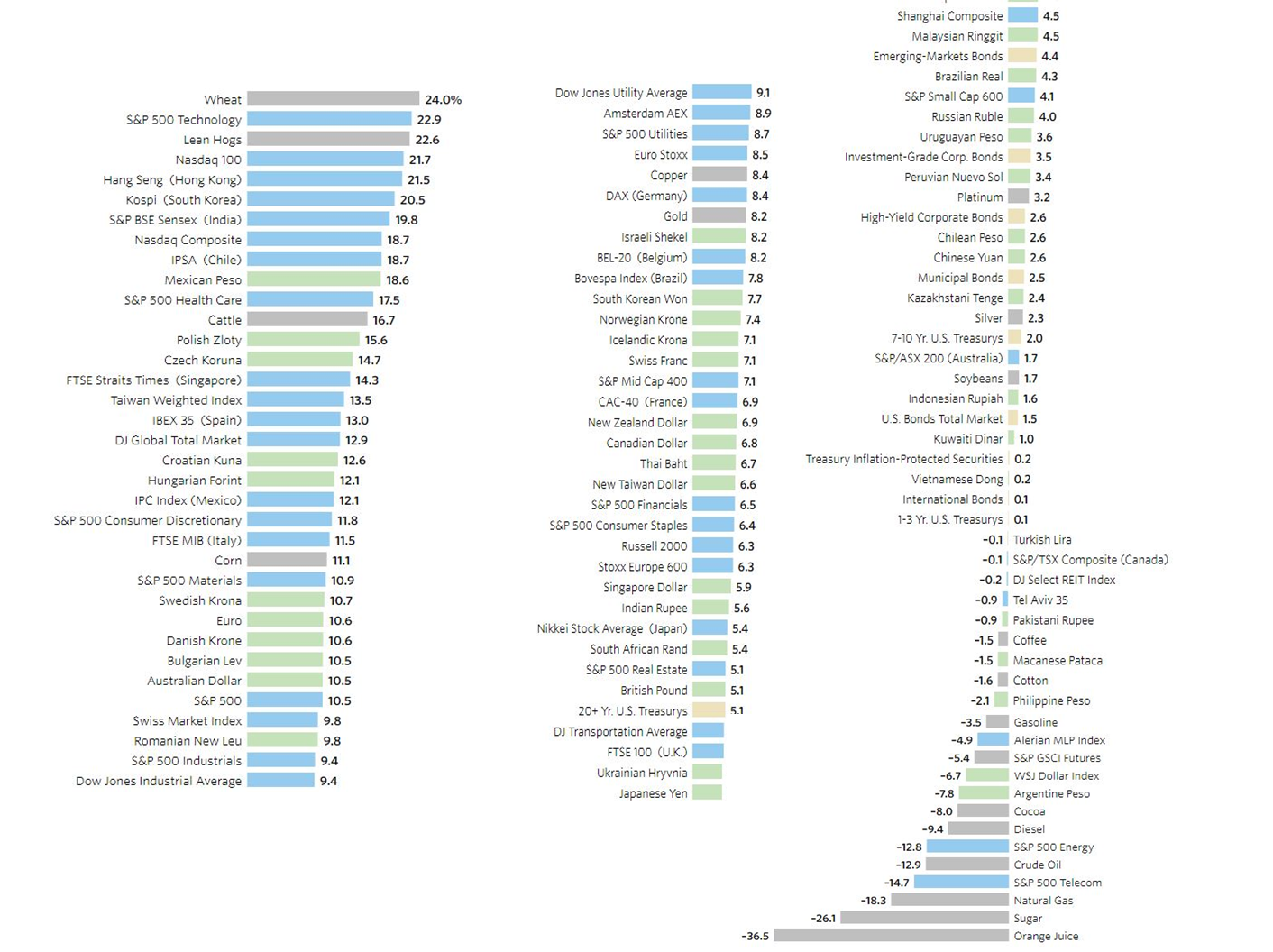

I have included a graphic below sourced from The Wall Street Journal, which illustrates the returns of numerous asset classes during the first-half of 2017. This can provide guidance on couple of levels including identifying holdings to add moving forward, as it displays what may be overbought and what may now be discounted from a historical perspective. It is also helpful when comparing the first half returns to your own holdings. I will note, however, that when doing that please remember that diversification and risk management processes provide meaningful benefits to the portfolio, and does at times result in a cost. Basically, if we were 100% exposed to Wheat to obtain that 24% return, we could have just as easily exposed 100% to Orange Juice for the -36.5% return. Finally, the S&P 500 is up nearly 18% since the election and the index just hit a new, all-time high in recent weeks. How long can these lofty values continue? God only knows, but we remain disciplined and prepared here at GDI headquarters.

Lastly, regarding real estate, RealAssets Adviser magazine reports Home prices rose 5.8% YoY and are about 40% above the lows from the housing crash. GDI has begun focusing on adding alternative investments for qualified clients in the diligent search for non-correlated returns. REIT’s and other real estate exposures can provide the benefit of stabilizing returns and mitigating risk for some. Please reach out to me directly to identify parameters and discuss risk management protocol if you are interested in adding alternative types of exposure(s).

Second-Half 2017 Outlook

The following is based on both first half realities, and the prospect that there are a few different paths the markets and globally exposed portfolios may take as we close 2017.

Stagnation vs. Reflation

Stagnation, which is lower Treasury yields, slow growth, declining inflation and defensive sector outperformance has started to replace the word reflation (the idea that economic growth is going to accelerate in the future) in a few of the publications I read regularly. Reflation is generally characterized by better growth, higher yields, higher inflation and cyclical sector outperformance. Having said that, there remains relatively stable support for the reflation “camp”. Black Rock recently reported that they, “Believe the current cycle won’t die of old age any time soon” and “The economy still has slack for the recovery to chug on.” They went on to assert that “A sharp earnings recovery is supporting equities globally” and that they “Favor markets outside the U.S”. I agree.

Other economic indicators, such as the Institute for Supply Management Manufacturing Purchasing Managers' Index ("PMI") which tracks the sentiment of purchasing managers across the U.S. manufacturing industry, rose to 57.8 in June. This is reported as the highest level in nearly three years and is an increase of 2.9 percentage points from the May reading of 54.9%. Additionally it is at its highest level since August 2014 when it registered 57.9%, indicating growth in new orders for the 10th consecutive month.

Debt Ceiling

Something that has not been discussed much by the talking heads in the financial media recently is the debt ceiling and potential for a government shutdown coming in October. The debt ceiling will need to be increased by early October and another spending bill will need to be passed or the government risks another shut down. Because Republicans control Congress and the White House, the odds of a shutdown are relatively low, however, if they wait until the very last moment to do both, it will very likely result in some market volatility. But remember, volatility and/or a deep correction provides an opportunity to add solid strategic assets to the portfolio and I will be presenting clients with just such opportunity should this occur.

China and the MSCI

Global index provider, MSCI, announced they will include Mainland Chinese equities (A-shares) tracked by the MSCI China A International Index to their Global Standard Indexes starting in May 2018. These indexes include the MSCI Emerging Markets, AC Asia Ex Japan, and ACWI Indexes. Upon full inclusion, which some experts suggest could take up to five years, the securities tracked by the MSCI China A International Index should grow to represent an additional 17% of the MSCI Emerging Markets Index. Krane Shares reports that “This should bring China’s weight overall (including Mainland, Hong Kong, and US listed Chinese stocks) to over 40%.” The impact to GDI managed funds is that it may translate to several hundred billion dollars of inflows from both active and passive managers into Chinese equities, pushing values much higher in the coming years.

The FED

The Fed meets again in mid-September and much of the recent meetings have resulted in a stable rate policy combined with a bit more “hawkish” tone on inflation. The likely outcome will be that they continue to reduce the size of their balance sheet and watch inflation indicators closely for any prompting to increase rates. The risk is that if the Fed becomes more aggressive than expected at removing easy policy and raising rates, the markets could sell off in another “Taper Tantrum”. I look for much of the same as it relates to the Fed and barring any huge movement in inflation, or a nasty “tail-event” economically, rates will be ratcheted higher and all policy will be communicated as such.

Conclusion

There is significant potential for market-moving events as we close 2017. Everything from an ongoing healthcare debate, to a government shutdown, to a new tax plan that may or may not be presented to the legislature, to a North Korea mess or intensifying Russian relationship tension, or an overbought S&P, or a hawkish Fed, or even a Trump Administration hiccup. Each of these, and many others I did not mention, would impact holdings on a multitude of levels. In times like these there is a quote from Warren Buffet that replays constantly in my head. He states, “Be fearful when others are greedy, and greedy when others are fearful”. Remember that we could also have a status quo market maintenance plan as we close 2017. Some have been speaking of a bubble for a while now and one has not really materialized. Remember, bubbles usually occur when most everyone begins to ignore the signs associated with their existence. We know for sure that there remains large amounts of liquidity chasing a higher level of returns due to low rates. Many investors may take all of the above risks and file them away for another time, which leaves us on track for continued stable returns as we end 2017.

Until next time Position Globally, Allocate Conservatively, Invest Completely

Year-end Commentary and Outlook for 2017

12/22/2016

As a year full of unexpected economic and political results comes to an end, there is an increasingly focused effort to uncover what investors can likely expect for 2017 and beyond. What’s more, in 2017 investors are faced with not just the traditional market-related concerns like portfolio risk and return, but also regulatory and geopolitical issues that will ultimately create an additional layer of uncertainty around performance, risk and portfolio management as a whole.

Based on a diligent focus on gathering an accurate perspective from the hundreds of documents I have read in recent weeks, the following will hopefully provide you with a solid outlook on what can be expected for 2017 and the years that follow.

US Equity Markets

To say that the US equity markets have responded well so far to the Trump presidency is an understatement. The prices are fundamentally the result of the expected economic benefits of Trump’s fiscal, tax and infrastructure plans. The market perceives that this will be the proverbial “shot in the arm” that the US needs to finally shake of any remnant of negativity from the Great Recession.

I would like to remind each of you that market participants tend to overreact to both good and bad news in the short-run, and this recent run up in pricing is no different. The fact is, fiscal and monetary stimulus and/or affects happen gradually over time and if history is any representation, they take extended amounts of time to work their way into the broader growth picture. Sometimes the affects take years, or multiples of years to be realized. The market has seemed to price a good portion of them in already and everyone is now getting excited about Dow 20k.

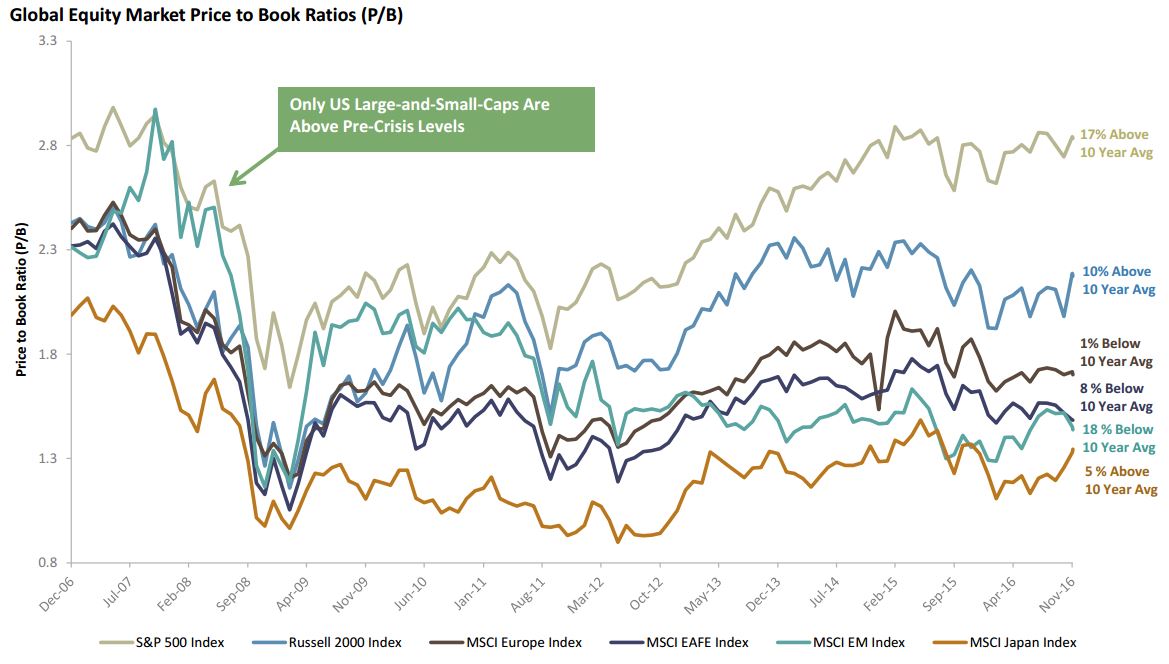

I have a couple of questions for you to consider. First, do you believe that these prices are the result of realistic expectations? And second, will the occurrence instigate a greater potential for volatility in coming months? My answers to both of those questions are no and yes respectively. This is what prompted the recent GDI sale of high price-to-earnings ratio assets. This was performed in order to lock in gains that have a risk of running away early next year and to create a cash cushion to exploit new opportunities that will come available in the coming months. I have included a graphic below which supports the reasoning behind liquidating the small portion of assets. From a price-to-book perspective, only US large and small caps are above pre-crisis levels. This is an indicator for me that those instruments have become “expensive” on a relative basis. Additionally, we will undoubtedly face higher rates in 2017, which will impact US companies meaningfully. LIBOR, which is an index used for a good deal of corporate borrowing costs, is at its highest since 2009 and is very likely going higher. As leveraged companies face borrowing cost pressures, some may then face painful capital constraints, which could impact earning potential for years to come.

US GDP Growth

Even when the previously described potential economic boosters from a Trump presidency are taken into account, 2017 will likely resemble 2016 in terms of US growth. Many expect GDP growth to remain at around 2% for the year. Basically, the aforementioned boosters may not even be felt for the first time until well into 2018. It is suggested also that the fiscal impacts of Trump’s plans could yield around 1% of GDP growth at the best case, and when that is combined with the reality of a large amount of baby boomers retiring and a declining productivity picture, any real positive impact, according to JP Morgan, would be hard pressed to pass 0.5%. Additionally, outside of the US, global growth is under pressure from aging populations, weak productivity growth and in some places, excess savings. If you are genuinely interested in digging into how each of these affects growth prospects, and impacts the GDI portfolio management methodology, I am happy to discuss the topic with you personally.

Inflation and Interest Rates

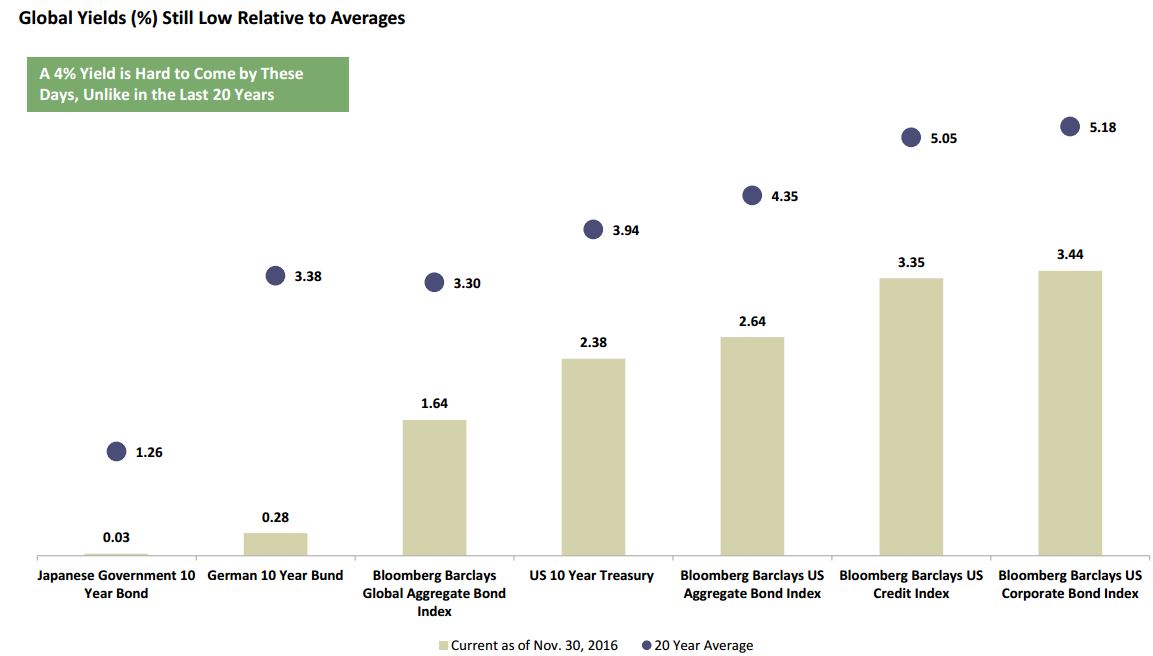

Regarding inflation and interest rates, we face the prospect of a new normal, that is not really “normal” at all. Rates have trended higher recently across the yield curve and have done so rather quickly. Additionally, we finally face real inflation pressures and the Fed’s preferred measure of inflation, as well as broader wage inflation are steadily increasing. Having said that, the Fed expects that it is very likely the level of inflation will remain around 2%, or just slightly higher for the year and they are acting accordingly. As a reminder, 2% is where the Fed tries to target inflation as it is their assessment that it is at that level which contributes to growth without being overly cumbersome to spending and economic growth. The US Fed has raised rates at their last meeting and are suggesting that two or three more increases will be realized in 2017. Though some feel a bit of worry about this, the broader point I would like to make revolves around not just the increases or the velocity of increases, but where interest rates need to get to in order to resemble “normal” from a historical standpoint. Though the 10 Year UST yield has gone up considerably in recent weeks to around 2.60%, it remains well below the 2007 yield of 5% and the 20-Year average (See chart below) of 3.94%. Though rates will go up along the entire curve, they will very likely remain relatively low compared to history, as “normal” is still a long way from here.

Rates in other parts of the world, namely parts of Europe and Asia, display a very different reality. As some of you may have heard, negative rates exist meaningfully in the world, and not just in small pockets of issuers/countries. For the sake of stimulus and “easy” policy, some of the world’s central banks have taken rates negative in order to incentivize investment and disincentivize holding cash. It is reported that over $10 trillion of holdings are currently priced at negative rates. There is still uncertainty surrounding how effective these policies are in terms of stimulating growth, however there is very little argument from anyone that it puts a great deal of pressure on investors to find earning assets that outperform inflation, let alone other market benchmarks.

Reflation vs. Stagflation

Before Trump was elected, there was a great deal of chatter about the risk of stagflation here in the US, which is basically inflation without growth. Though the prospect of stagflation has not been completely removed due to significant hurdles around the president elect’s plan, the likelihood is diminishing more and more everyday. Now that he was won the election, those same authors and commentators are now leaning toward the reflation camp in 2017. Reflation is where growth, earnings, inflation and stock prices all move up at the same time. Based on the proposed tax cuts, the repatriation of offshore taxes, decreased regulatory pressures, infrastructure spending and improving stability in the Eurozone, reflation is more of a potential than at any time in recent history. But as mentioned in my opening comment, this will take a good deal of time to be realized and there are significant risks to that outcome (Detailed in the “Key Risks in 2017” section below).

Portfolio Design

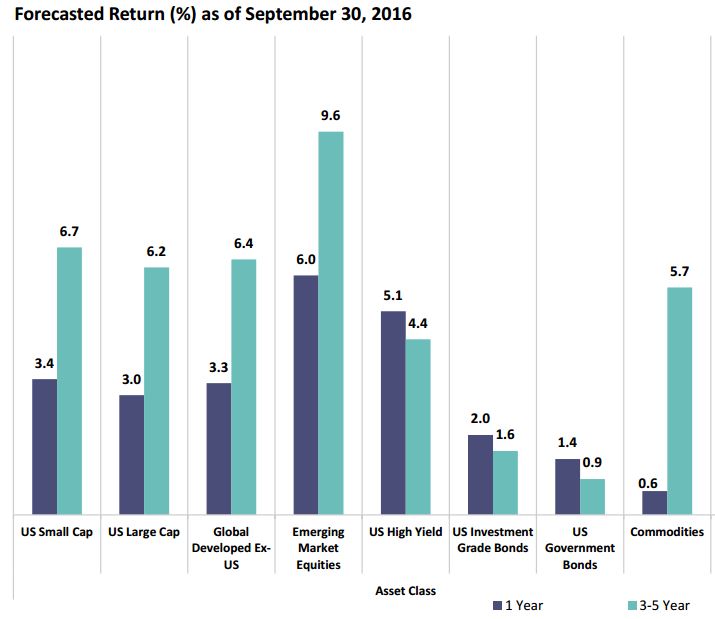

Portfolio allocation considerations, including diversification and expected returns will also be very similar to those implemented in 2016. Though we face many new uncertainties in 2017, we can expect a few things with a strong level of confidence. We can expect 1. Higher Rates 2. Higher inflation and 3. USD volatility. Considering these, strategic exposures to instruments that are well placed in that environment are key. As a GDI client, you are provided with a detailed portfolio structure that accomplishes this, as well as fits your unique financial realities. I am happy to discuss specific holdings and investment strategy with you personally as providing investment advice is not what this commentary is intended for. I have included a forecast from State Street Global Advisors below, which supports the broader GDI allocation mandate. This mandate is driven by the goal of obtaining exposure(s) strategically at a time when the market is discounting (or hating in some cases) them and then realize gains when exposure(s) become over-valued (20 times earnings or higher) in order to hedge against the likelihood of a correction in that exposure(s).

Key Risks in 2017

Geopolitical risks resulting from growing global populism and the uncertainties of a President Trump impact on broader US and international trade relations.

There are risks to growth, and even a potential for a credit default epidemic due to the impact to companies and the consumer from the continuing rise of interest rates. Corporate debt as a percentage of GDP is relatively high compared to recent years and TransUnion recently came out with a statement suggesting they expect credit card default levels in 2017 to resemble those realized back in 2009.

The risk that Trump’s corporate tax reform may not become reality, which will undoubtedly impact US companies (and investors) negatively.

A “hard” Brexit and/or Ita-leave. Both of these driven by financial and economic realities in the Eurozone that are putting serious pressure on capital. If the Eurozone begins to really become unstable, a positive outlook can become neutral, or even negative very quickly.

The DOL Fiduciary rule, which has placed a greater level fiduciary responsibility on all investment advisers, especially those that provide advice for retirement assets. This has the potential to motivate advisors to build “cookie-cutter” style portfolios which include assets that do not require the extensive amount of justification and client engagement the rule necessitates. This is not as big of an issue for GDI clients, as each has a specific strategy and detailed proposal for action, although it provides the potential to pressure some assets and the broader business as a result. There are also some suggesting that a President Trump will reverse or minimize some of these cumbersome new regulatory realities, however, many of us in this business are approaching these rules with the highest level of scrutiny and compliance.

Until next time Position Globally, Allocate Conservatively, Invest Completely

11/01/2016 - Election Day in the US is Coming!

Pervasive uncertainty and volatility in the markets can cause many investors to increase the intensity of worry relating to the future value of their investment holdings. Though GDI clients are well-diversified from a broader perspective, we are approaching what Mr. Arone from State Street called “One of the most dichotomous US presidential elections in history”. There is some suggestion that a Trump victory would upset the markets much like the way Brexit did just a few months ago. Based on this assertion, and many others you have likely heard or read about recently, I have provided some high-level guidance below.

First, I would like to highlight what happened after some time passed beyond the Brexit vote. All of the fear and selling resulted in investors recognizing losses on assets that ultimately came back to their pre-Brexit valuations. Some holdings, in fact, began to perform better as savvy investors (GDI clients) were strategically exposed to diversified holdings in just such assets. This is very likely the same reaction and result we will experience should Trump become President. The reality is, assets are priced based on expected value and even if that is skewed by market participants for a period of time, most assets return to “fair-value” based on the future expectations of those particular holdings. What’s more, some assets, such as metals, energy, financials and housing are suggested to potentially outperform in a Trump presidency. Most are suggesting that the reason a Clinton victory would not upset the market relates simply to the fact that she is viewed as “more of the same” in relation to the current administration, and that outcome is already “priced in”. There is also the uncertainty surrounding the outcome(s) in Congress. All I can say about that is that in 7 days, we will know the reality with a high degree of certainty. But again, worry adds nothing but preparation, diligence, discipline and strategy adds value and understanding.

Second, many of you have listened and implemented my fundamental approach and conclusions about investing over the years and have experienced stable, risk-managed and often times superior returns as a result. I will simply state that even though the upcoming volatility from the uncertainty of the presidential and other elections might be extremely uncomfortable, please remember that the pragmatic, value-based and diversified approach we have implemented in previous years continues to be the soundest approach for medium-to-long-term returns going forward. The global economy is expected to grow, the USD continues to face depreciation pressures, and many hated assets of late are showing lasting signs of appreciation through 2017.

Lastly, I remain available to chat about your portfolio, the markets, or anything else for that matter. I read a multitude of commentaries on a daily basis and establish positions in the market according to strategic implementation of risk factors and overall return expectations. If you want to know the details about any market or exposure, I would be most happy to chat.

Until next time, Position Globally, Allocate Conservatively, and Invest Completely.

Brexit? What will it mean for the markets?

Some of you may be wondering what the so called "Brexit" vote happening in the UK this afternoon/evening (our time) will have on the global markets and to your GDI-managed portfolio specifically.

I will start by saying that this particular referendum vote in the UK has the potential to be one of the most significant market movers we have seen in a very long time. The reason for the market volatility potential relates primarily to the significance of disrupting the status quo of the UK being a member of the European Union for four decades. There is just too much uncertainty around will happen to the broader economy of the UK, the EU and the rest of the world for that matter, if they vote to leave the EU. And as we all know, the markets to do not like uncertainty in any form and a "leave" vote will cause declines in just about every asset outside of safe-haven holdings. (Every GDI client owns a sub-set of safe-haven assets as a hedge).

I will not bore you with the political details of the Brexit, however, I will state that the fundamentals around the Brexit referendum relate to the battle between two things: 1.Economic well-being and 2. Immigration reform. The EU allows for an immigration process that is very lenient and citizens of the UK are fed up with it. What some of those voting in this referendum do not comprehend is that sacrificing economic wellness for immigration reform is draconian at best, and deadly at worst. The reason they do not comprehend this relates to the basic characteristics of those voting to leave. Usually they are young, with very little assets and care more about making a political point than about damaging the economy.

I will close by stating that as it stands, there is only about a 30% risk of a "leave" vote, which is not enough certainty to liquidate assets ahead of the vote. Also, you must remember that if the assets are chosen based on sound fundamentals and value, a price decline due to fear is not a quality reason to sell in the short-run. I recommend weathering the storm of a decline as GDI-managed portfolios are diversified and hold sound assets meant to provide value in the coming years. If the vote is to "remain", we will recognize continued appreciation in the portfolio values that we have seen in recent weeks.

Until next time, Position Globally, Allocate Conservatively, Invest Completely

Portfolio Rebalancing Effectiveness Update

March, 2016

Effectiveness of 2nd half 2015 portfolio rebalancing:

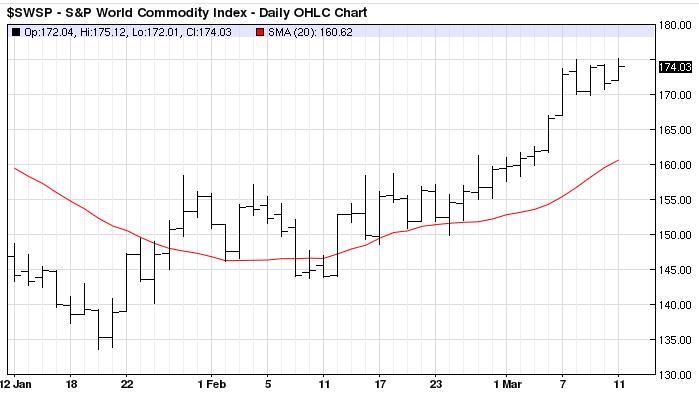

US Dollar (USD) value, when compared to other global currencies remains under pressure as we conclude the first quarter of 2016. Many of the fundamental domestic and global economic conditions described in GDI’s publication of A Case for Portfolio Rebalancing late last year are quickly becoming a reality. The conclusion that can be drawn is that those GDI clients that engaged in proactive portfolio rebalancing late summer 2015, mitigated losses on many exposures and are now beginning to see outsized gains in a subset of the rebalanced portfolio. To represent one particular segment of rebalancing that included strategic exposures, I have included a graphic of the S&P World Commodity Index below. The image below displays that the index has turned positive and has been moving higher in the last couple of months. The 20 Day Moving Average is represented as the red line and also displays a trend toward higher values by its shape.

USD:

The USD has declined and stabilized over the last 6 months, though remains under pressure for continued decline due to the technical realities (see graphic below) and the outstanding USD that was created from the large levels of USD printing by the Federal Government after the Great Recession. Even with the Fed on a tightening path where they have recently raised rates, there continues to be increasing chatter about wage inflation, which is a significant component of broader inflation pressures. As USD declines, and inflation increases, the strategically rebalanced assets will outperform compared to the broader market as we enter mid-2016.

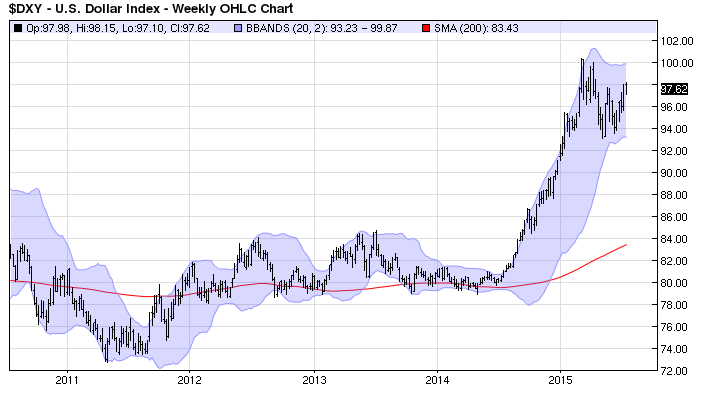

The chart below displays the US Dollar Index, which measures the USD against a basket of global currencies. Note the red line, which is a 200-day simple moving average. From a technical perspective, prices generally revert back to averages when looking over medium-to-longer-term. USD remains nearly 10% (15% late last summer) above its 200-day moving average as represented in the DXY.

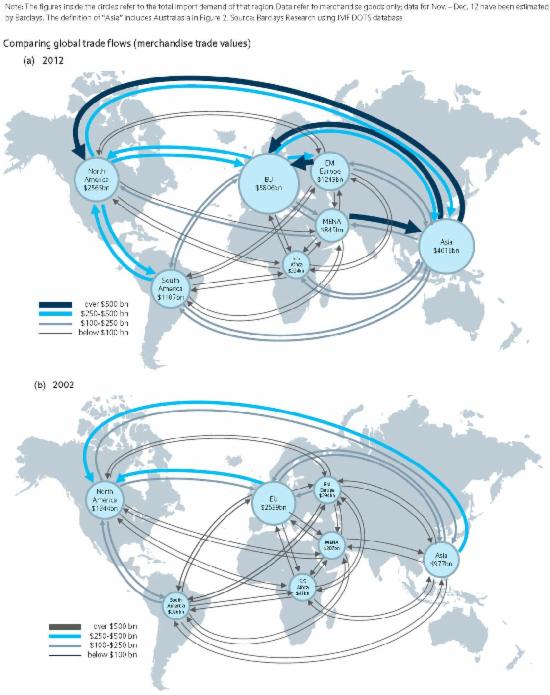

As expected, last October, the IMF approved the inclusion of the Chinese Renminbi/Yuan (CNY) into its basket of currencies in the enviable position of “Reserve” currency status. This coming October 2016 is when the inclusion becomes fully active and most market participants are not clear on what the real outcome and broader market impact will look like. The GDI rebalancing was designed to hedge against the risk of a broader sell-off in USD.

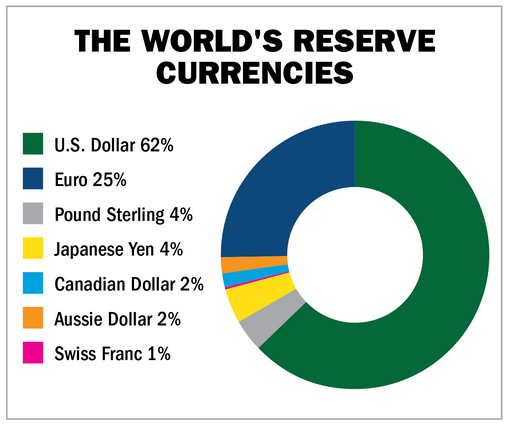

As previously mentioned, global trade is currently transacted in the currency set listed below, where USD holds the majority spot. What this does is:

- Maintain a steady demand for USD, no matter what the sub-optimal fundamentals are for the currency (low rates, money printing etc.)

- Enable another alternative global power to take a percentage of its “market-share”.

Will China take a significant portion of the reserve currency transactions in coming years? China recently overtook the United States as the world’s largest economy in terms of purchasing power (IMF reported) and a great deal of business is done between China and the rest of the world as they are the number one exporter in the world. There will very likely be at least a 10% change in USD reserve levels compared to CNY as we end 2016. The outcome on USD remains uncertain overall, however, as a GDI client, you are prepared to weather the risks associated with a broad spectrum of outcomes.

Circumstances that can reduce the level of effectiveness in the GDI Rebalancing Plan into 2016:

- The US Dollar has maintained its dominance as the primary reserve currency for a very long time and the idea that confidence in China will match that of the United States is short of ridiculous, especially given the recent equity and real estate market realities there.

- The confidence in a “managed-floating” currency, which CNY is, compared to a free floating currency such as the USD is a two-edged-sword. On one hand the value is stable, but on the other, the value may not represent the true economic conditions and could limit the upside for investors holding CNY and CNY investments.

- It may just be too much trouble for large global organizations to update their policies and procedures in a timely manner in order to accommodate the CNY as part of their ongoing financial operations. This could delay the incorporation of CNY into the broader global economic landscape.

Conclusion and Results of Action Plan:

As expected, many of the investment holdings that were rebalanced to are up by multiples of % since they were purchased. There remains a good bit of distance to cover still and this initial appreciation of values is a small indicator of what is likely to come.

A Case for Portfolio Rebalancing

July, 2015

Argument for 2nd half 2015 portfolio rebalancing:

US Dollar (USD) value, when compared to other global currencies, is under pressure as we close 2015 due to changes in fundamental domestic and global economic conditions. Those pressures could very likely become more intense as we close 2015 and portfolios should be rebalanced accordingly. There remains a relatively low risk for a “crash” scenario for global asset values, however, a proactive portfolio approach to a declining USD is paramount.

Premises:

Premise ONE: The USD has been under pressure for decline over the last year due to technical realities (see graphic below) and large levels of USD printing by the government after the Great Recession, as well as a looming threat of inflation.

The chart below displays the US Dollar index, which measures the USD against a basket of global currencies. Note the red line, which is a 200-day simple moving average. From a technical perspective, prices generally revert back to averages when looking over medium-to-longer-term. USD remains nearly 15% above its 200-day moving average as represented in the DXY.

Premise TWO: In October, it is reported that the IMF will be considering, and very likely approving, the inclusion of the Chinese Renminbi/Yuan (CNY) into its basket of currencies in the enviable position of “Reserve” currency status.

Basically, global trade is transacted in the currency set listed below, where USD holds the majority spot. What this does is:

- Maintain a steady demand for USD, no matter what the sub-optimal fundamentals are for the currency (low rates, money printing etc.)

- Enable another alternative global power to take a percentage of its “market-share”.

Source: Stansbury Research

Will China take a significant portion of the reserve currency transactions in coming years? China recently overtook the United States as the world’s largest economy in terms of purchasing power (IMF reported) and a great deal of business is done between China and the rest of the world as they are the number one exporter in the world. It is also reported that largest cell phone companies there has more subscribers than the entire population of the United States. The evidence points toward at least a 10% change in USD reserve levels compared to CNY.

Circumstances that reduce the level of confidence in the above described scenario:

- The US Dollar has maintained its dominance as the primary reserve currency for a very long time and the idea that confidence in China will match that of the United States is short of ridiculous, especially given the recent equity and real estate market realities there.

- The confidence in a “managed-floating” currency, which CNY is, compared to a free floating currency such as the USD is a two-edged-sword. On one hand the value is stable, but on the other, the value may not represent the true economic conditions and could limit the upside for investors holding CNY and CNY investments.

- It may just be too much trouble for large global organizations to update their policies and procedures in a timely manner in order to accommodate the CNY as part of their ongoing financial operations. This could delay the incorporation of CNY into the broader global economic landscape.

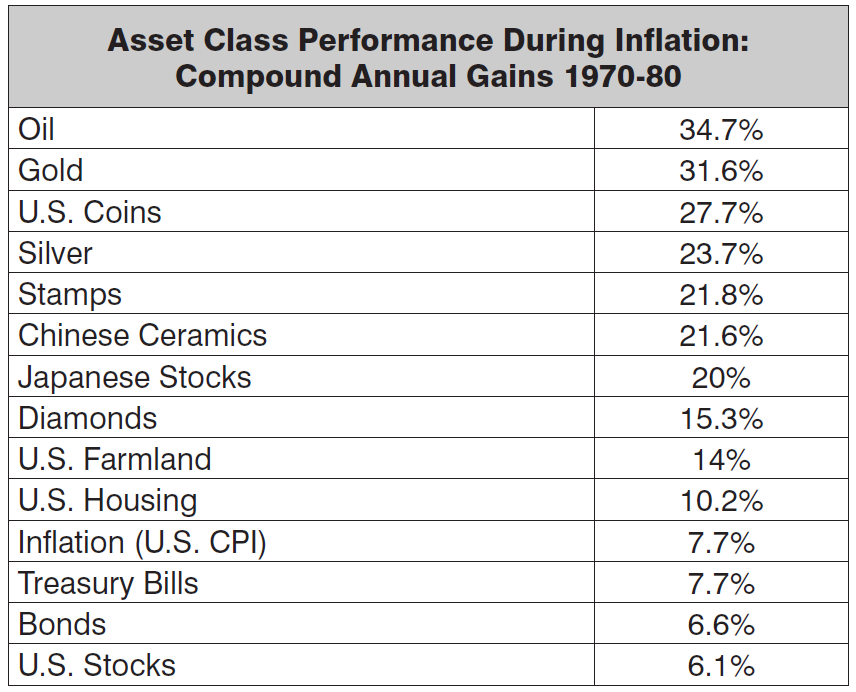

Conclusion and Fundamental Action Plan:

The details below are used to establish a basic framework and display which assets perform well in USD depreciation scenario. Note that each GDI client will have the opportunity to evaluate and approve their individualized portfolio plan using this and other pertinent data. The information provided is simply a guide for how to approach successfully preparing portfolios for the very real potential for USD depreciation. The asset classes below performed the best in the previous USD devaluation of 30% in the 1970’s.

Source: Stansbury Research

Until next time Position Globally, Allocate Conservatively, Invest Completely

6/01/2015

- Jobs, growth and inflation numbers are keeping the potential open for a U.S. Fed interest rate increases as early as September. There remains reasonable arguments for the Fed to start tightening policy at that time, however, there is also a risk to the markets as we close 2015 (more on that later) that could easily delay any tightening. Fed Funds Futures are now pointing toward Q1 2016 for the first tightening. The data in the next few months will ultimately drive the timeline.

- The US Dollar has been trading relatively high against a basket of foreign currencies in recent months and remains “at risk” for devaluation based on technical indicators such as Moving Averages and interest rates. What this means for our portfolios is the Emerging Market and Commodity/Energy components will outperform should the USD decline. This is also very data dependent and is top-of-mind here at GDI.

- Risks for volatility as we close out the second half of the year is reasonably high. There are some market participants that are calling for a drastic decline in market values in September/October 2015 due to extenuating circumstances around the world and historical statistical analysis. I remain committed to a fundamental strategy of diversified holdings in our portfolios and want you to be aware that any drastic pricing declines are driven by emotions, and not by fundamental considerations. If our portfolios lose value in those months, we will remain invested and well positioned for fundamental returns in the following quarters. If you feel strongly about removing risk from the portfolio (which also removes potential for return), please contact me soon.

Until next time Position Globally, Allocate Conservatively, Invest Completely

03/10/2015

The last few trading days have provided all of us with a heavy dose of unwelcome volatility in asset valuations. This update is intended to provide you with some additional detail in order to help make more sense of what is actually going on.

I will first state that that a certain amount of volatility was expected due to where we find ourselves in the recovery timeline. We are six years into a decidedly bull market which occurred after the most painful recession since the Great Depression. What's more, after a few years go by in any recovery the broader market simply doubts the potential for continued positive growth. I would like to highlight, however, that even though the broader market is pessimistic about opportunity and growth, I am not. All the talk of bubbles makes me, well, crazy. In order to have a bubble, most participants will be irrational and overly optimistic about numerous assets. We do not have that, at all. As represented in prices recently, many participants remain very fearful and pessimistic and my guess is most people you all talk to feel similarly. It is when everyone feels great about the market and starts to buy things they cannot afford that I become worried of bubbles.

Secondly, the recent declines in the markets are related to stronger jobs numbers and an improving U.S. economic picture and the reaction of the Fed to interest rates. Now does that make sense? The way I make sense of it is explaining it like a cocaine addict having their cocaine taken away. They don't need it to survive, and they will undoubtedly be healthier without it, however, will they let you just take it away? No, and the market is not happy about the Fed taking away the super cheap money that has been made available for many years now.

Third, the U.S. Dollar is moving higher, which only improves the inflation landscape. Basically, the U.S. Fed has a dual mandate, where the primary objective is inflation control (like most other global central banks) and secondary is the improvement in jobs and labor to the level they describe as "Full Employment", which is where it is now at 5.5%. So as the U.S. dollar strengthens, inflation pressures are eased. As it weakens, inflation pressures increase. Right now inflation is at the Fed's target of ~2% per year. The Fed will very likely increase rates this year, we just don't know when.

In conclusion, I would like all of my clients to understand that the fundamentals around growth here in the U.S. and globally remain positive. Though the Eurozone and parts of Asia are experiencing a few negative economic pressures, the world is improving overall and the diversified portfolios we are all invested in will benefit longer term as a result. The world will continue to buy things, use energy and invest their earnings into the markets, into their businesses and/or into education. All of these things are positive for our portfolios as we are invested for the medium to longer-term. Don't let the recent market declines and volatility get you down as it is temporary. Most of you have done extremely well in the beginning of 2015 and as long as no major bad news like wars etc. are released, there is no doubt those values will return in the next few months.

Until next time Position Globally, Allocate Conservatively, Invest Completely,

02/27/2015

The title of the 60’s movie, The Good, the Bad and the Ugly has been historically used as a tool to describe situations with varying outcomes that occur over a certain time period. I will continue in that tradition in this commentary in the hopes that it provides you with some much-needed clarity.

The “Good” is the easiest to describe since there has been more good than bad or ugly as we start 2015. Global markets have performed well over the last year as the S&P 500 is up over 12%, the DAX in Germany is up over 17%, the FTSE (UK) is up 4.5%, and considering the deflation issue and currency issues in Japan, the Nikkei is still up nearly 25% Year-over-Year. Non-farm payrolls and personal incomes have both showed signs of improving and we have realized some of the best readings in jobs numbers since the late 90’s and early 2000’s. Oil and fuel (until this week) have both come down significantly in the last year as oil remains 40% below year-ago levels. Industrial production was also reported to be up nearly 5% and Durable Goods just over 7% for the year and inflation, as measured by the Producer Price Index (PPI), was down nearly 1% in January alone. I will qualify that statistic by stating that gasoline prices were down 24% for the month and likely had a favorable impact on producer costs overall. Though I do expect continued volatility in prices in the coming months, I remain optimistic about overall global growth and market gains through the remainder of 2015.